How to calculate borrowing capacity

How To Calculate Your Mortgage Borrowing Capacity. So on that same loan amount you would need to show a.

Floating Interest Rate Formula And Calculator

Find out how lenders calculate your borrowing.

. It is one of the 5 Cs of Credit analysis. View your borrowing capacity and estimated home loan repayments. Ad Get a Business Loan From The Top 7 Online Lenders.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Our home loan borrowing capacity calculator asks a few personal and financial questions to calculate an estimate of how much you may be able to borrow with Pepper. Thus as part of calculating your borrowing capacity it is also wise to ask your lender what is going to be the interest rate for your loan.

Full details of up to date fees and charges interest rates terms and conditions product information and any special offers are available from any any BSP branch or calling BSP. For a conventional loan your DTI ration cannot exceed 36. Standard borrowing capacity is between 30 and 40 of income which means that debt should never exceed 13 of the individuals remuneration.

Your credit report is one of the most significant factors determining your borrowing capacity. Under tighter serviceability rules your bank may assess your borrowing power at principal and interest PI at 750 or even higher. The Bank of Spain advises that the.

Borrowing capacity is a calculation that indicates the. Essentially the report details your relationship with credit your ability to repay debt and any. Estimate how much you can borrow for.

Estimate how much you can borrow for your home loan using our borrowing power calculator. Your borrowing capacity is the. Grow Your Business Now.

Your borrowing power will vary. Borrowing Capacity Calculator Please enter the information requested in the form to calculate the monthly repayments on your Loan. To calculate your borrowing power we take into account a couple of key pieces of information your income and your debts.

This borrowing capacity calculator will allow you to estimate the amount that you likely will be able to borrow. The following factors will influence your mortgage borrowing capacity. We must multiply the result.

Once you entered your values click on Calculate to get your Borrowing Capacity. Borrowing capacity Self-financing capacity 3 or even 4 If you have to multiply by 3 or even 4 its because the banks consider that you can repay your loan over 3 or even 4. The borrowing capacity calculator will help give you the confidence to purchase your home.

Get an estimate in 2 minutes. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home. Gross income - tax - living expenses - existing commitments - new.

You can borrow up to 716000. To calculate the borrowing capacity of a business there are many things to take into accountIndeed the bank will study various parameters in order to make a budget forecast. Therefore you have to relate your personal revenue.

The first and most obvious factor is your. A debt to equity ratio that is. I am trying to use an excel formula to calculate the maximum amount that a person can borrow.

I have used the PV formula and while it gives an approximate amount I. The borrowing capacity formula Lenders generally follow a basic formula to calculate your borrowing capacity. Calculate how much you can borrow to buy a new home.

Your total minimum monthly debt is divided by your gross monthly income to express your Debt-to-Income ration DTI. Your borrowing power will vary between banks and lenders. Your debt-to-income ratio is a metric that your loan officer will use.

Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Based on the income and financial commitments you entered you do not meet the. Borrowing power or borrowing capacity refers to the estimated amount that you may.

Customer Management Crm And Suppliers Proper Management Of Customers And Suppliers Increases The Organizational Efficiency And Investing Crm Organizational

Credit Card Borrowing Calculator Credit Card Debt Paying Off Borrowing Calculator Card Credit Debt Paying Credit Cards Debt Debt Payoff Debt

Annual Percentage Rate Apr Formula And Calculator

Loan Calculator Borrowing Responsibly Mathematics For The Liberal Arts Corequisite

Paid In Kind Pik Interest Formula And Calculator

Grade 3 Maths Worksheets Subtraction 4 3 The 4 And 5 Digit Numbers Subtraction Word Problems Subtraction Word Problems Word Problems Word Problem Worksheets

How Much Can I Borrow Depending On My Deposit Mozo

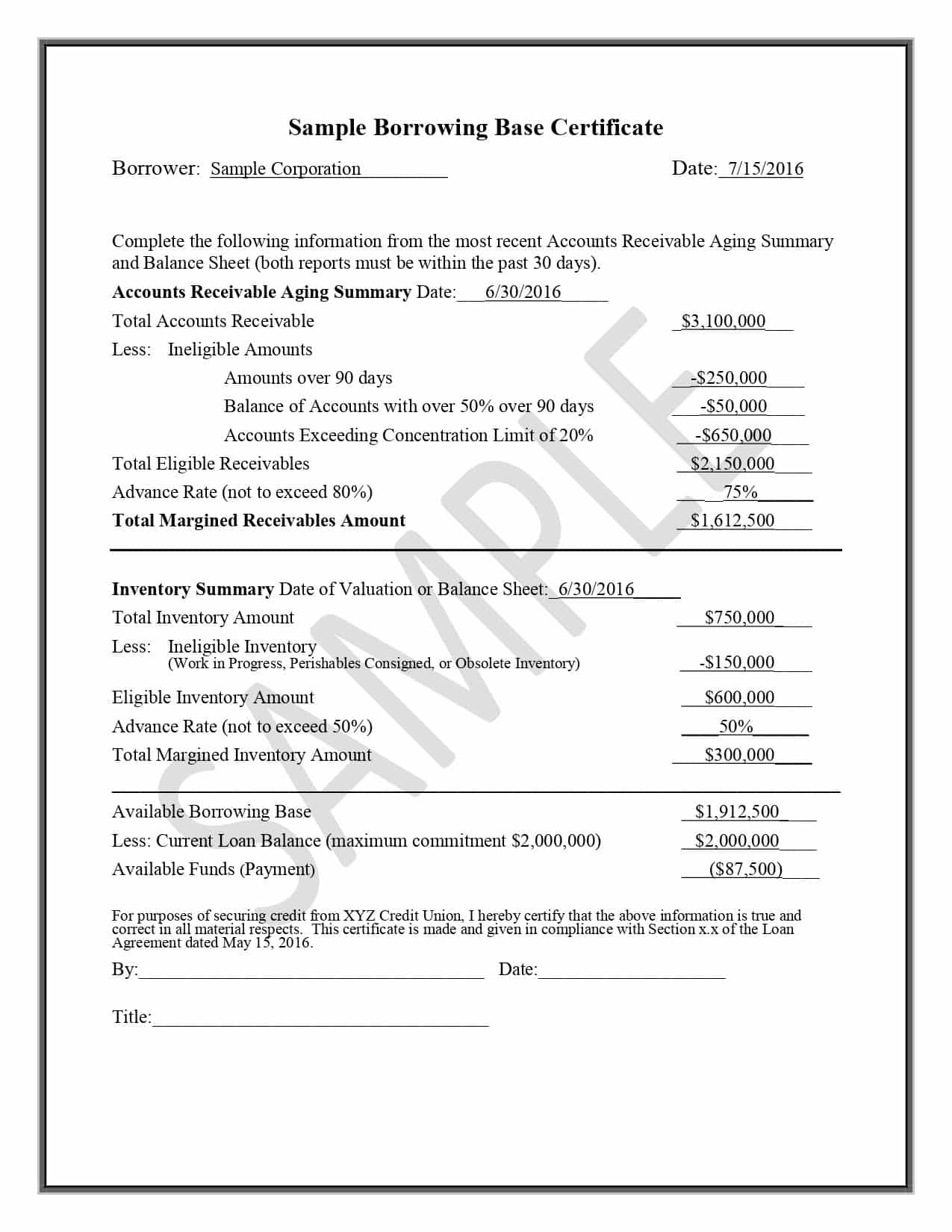

Borrowing Base What It Is How To Calculate It

Debt Capacity Metrics Ratios To Assess A Company S Debt Capacity

Free 9 Home Affordability Calculator Samples And Templates In Excel

Loan Calculator Borrowing Responsibly Mathematics For The Liberal Arts Corequisite

Buying A House Here Is The Home Loan Application Process If You Need Help Please Call Mortgage Choice Jody Shadg Loan Application Mortgage Mortgage Lenders

Download Microsoft Excel Simple Loan Calculator Spreadsheet Xlsx Excel Basic Loan Amortization Schedule Template

Debt To Equity Ratio Debt To Equity Ratio Equity Ratio Equity

Sales Quantity Variance Budgeting Financial Management Accounting And Finance

Borrowing Base What It Is How To Calculate It

Loan Calculator Borrowing Responsibly Mathematics For The Liberal Arts Corequisite